New tax depreciation changes increase appeal of new over old property

Investors of second-hand properties will be disadvantaged compared to investors of new properties following the 2017-18 Federal Budget announcement proposing tighter restrictions on depreciation claims relating to plant and equipment deductions.

According to tax depreciation specialists, BMT, under the proposed changes, investors who exchange contracts on a second-hand residential property after 7:30pm on 9th May 2017 will no longer be able to claim depreciation on plant and equipment assets installed at the time of settlement.

Investors who purchase a new property will be able to continue to claim these items as they were previously.

“It is expected that investors will be able to depreciate the plant and equipment assets within a brand-new property as they have been previously which is a clear advantage over second-hand property,” said BMT Tax Depreciation Chief Executive Officer, Bradley Beer.

“Plant and equipment assets” are the easily removable or mechanical assets found within an investment property, such as air conditioners, hot water systems, smoke alarms, garbage bins, blinds and curtains.

“This is extremely positive news for all property investors of brand new dwellings with a buy and hold strategy, and represents a key benefit for buying new property over old,” said National Apartments Manager, William Mitchell.

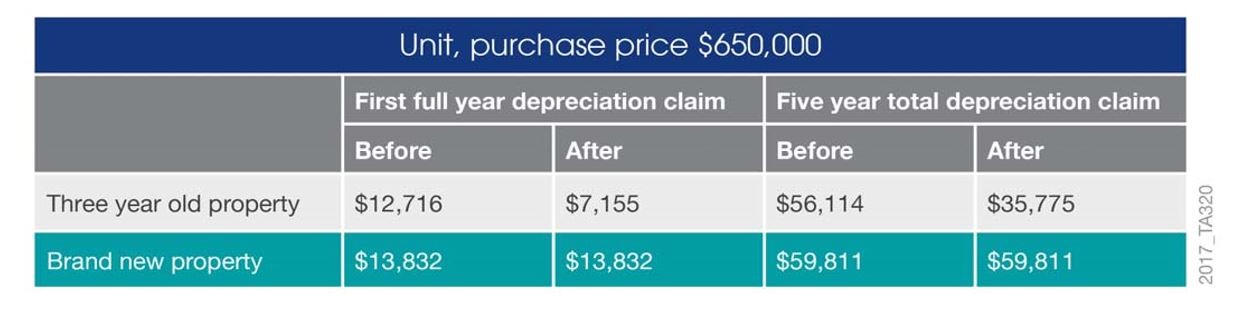

“As the example from BMT demonstrates, the difference between the depreciation claimable for second-hand versus new properties is substantial; representing potentially thousands of dollars-worth of depreciation entitlements each year, particularly in the first five years,” he said.

Depreciation scenario – purchasing before and after 9th May 2017. Source: BMT Tax Depreciation

The depreciation deductions in this example have been calculated using the diminishing value method.

According to BMT, investors will still be eligible to claim capital works deductions on the structure of the building on properties that commenced construction after 16th September 1987.

Investors who exchanged contracts prior to the 9th of May 2017 can still claim plant and equipment depreciation per normal.

For more information see: www.bmtqs.com.au or book an appointment with you local Ironfish property investment Strategist.